KC Select Income Fund

Keystone is the responsible entity and investment manager of the KC Select Income Fund. The KC Select Income Fund is a contributory mortgage fund that allows investors to invest in an individual loan or to create their own portfolio of individual loans that suit their personal risk / return appetite.

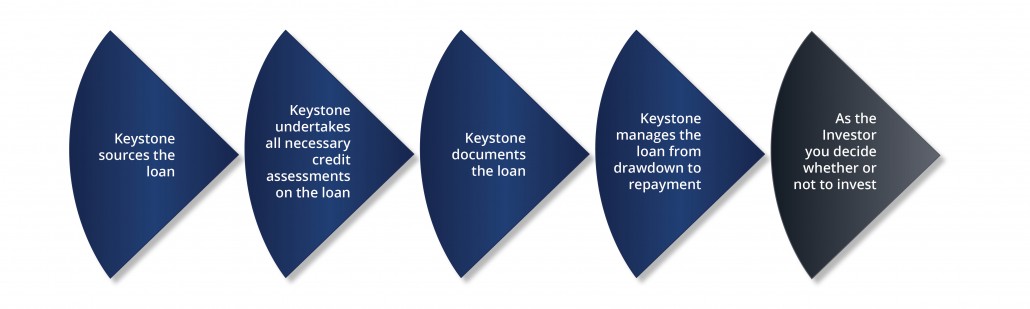

As the investment manager: Keystone sources the loan – undertakes the credit assessment – documents the loan – manages the loan from drawdown to repayment.

As the investor: You decide whether or not to invest.

How It Works

An investment in the KC Select Income Fund is a two stage process;

Stage 1 – Registration

Become a Member of the Fund by completing the Application Form contained in the Product Disclosure Statement (“PDS”). Request PDS.

Stage 2 – Investment

As a Member of the Fund, Keystone will offer you the opportunity to invest in first and second mortgage investments which underlay individual Sub-Schemes of the Fund; The offer to invest in specific mortgage investments will be contained in a Supplementary Product Disclosure Statement (“SPDS”). The SPDS will contain all of the information you as a Member require to make an informed decision as to whether to opt in or opt out of the loan investment. As a Member of the Fund, it is you who makes the final decision of whether to invest all, some or none of your investment funds in any given Sub-Scheme

Benefits Of Investing

Control

As a Member, you have total control over the investment decision. Keystone sources the loan, undertakes the credit assessment, documents the loan and manages the loan from drawdown to repayment. But you as the Member makes the decision whether or not to invest.

Diversification

Members of the Fund are presented with a broad range of loan investment opportunities with differing risk and return characteristics. This enables each Member to build their own portfolio of loan investments that best suits their unique risk and return criteria.

Investment Alternative

An investment in the KC Select Income Fund provides investors with access to a class of investment asset that is often problematic to source, providing the investor’s portfolio with diversification away from listed equities, direct property and government and corporate bonds.

Transparency

The Supplementary Information memorandum for a given loan investment when read in conjunction with the Information Memorandum will provide all of the pertinent information related to the loan investment as well as the rights and obligations of the Member, the Borrower and Keystone.

Experience and Oversight

Investors are able to benefit from Keystone Capital’s ability to source quality loan investments throughout Australia as well as the 150+ years of experience in combined expertise in property, banking, credit analysis, compliance and funds management held by the board and credit committee.

Fund FAQs

Q: How do I become a Member of the KC Select Income Fund?

A: Simply complete the Application Form which is contained within our Product Disclosure Statement and send it to us along with your Identification documents. Request PDS.

Q: What is the minimum investment I can make?

A: The minimum investment in the KC Select Income Fund is $25,000. The minimum investment in any given loan investment is $25,000.

Q: What sort of return on my investment can I expect?

A: The target return on first mortgage loan investments range from 8.50% to 10.50% p.a., whilst the target return on second mortgage loan investments range from 14.00% to 18.00% p.a.

Q: Do I have a say in the kind of mortgage my money is invested in?

A: Yes, the decision to invest or not invest in any given loan investment is entirely up to you. Interests in all loan investments are allocated strictly on a “first in first served” basis.

Q: How long do I need to invest for?

A: Members of the Fund are issued with Supplementary Product Disclosure Statement for each loan investment (“SPDS”). The SPDS will provide you with details of the loan, the borrower and the expected term of the loan. Loans are generally for terms of between 6 months and 2 years. Unless a substitute investor can be found, once your funds have been allocated to a loan investment it is not possible to withdraw until the loan has been repaid. Where your monies have not been allocated to a loan investment you may withdraw all or part of your capital with 5 business days written notice

Q: What does the KC Select Income Fund invest in?

A: Generally speaking, the KC Select Income Fund invests in loans secured by vacant land, residential, commercial, industrial or retail real estate, including construction and development loans. The KC Select Income Fund does not engage in lending activities which are subject to the National Consumer Credit Protection Act.

Q: How secure is my investment?

A: Your investment in the Fund is not capital guaranteed however as all loans have been rigorously assessed against Keystone Capital’s credit criteria, approved by Keystone Capital’s credit committee and are secured by either a first or second mortgage over either freehold or Crown leasehold land much of the risk of capital loss on your investment is mitigated. As the KC Select Income Fund is not a debenture issuer or a pooled fund, as an investor you are only exposed to the loan(s) that you have consented to invest in.

Q: Are there any entry or exit fees?

A: There are no entry or exit fees payable to be a member of the KC Select Income Fund.